Triple candlestick patterns are a group of candlestick patterns that are formed by three consecutive candles. There are several different triple candlestick patterns, each with their own unique characteristics and implications for the market. Some examples of triple candlestick patterns include:

-

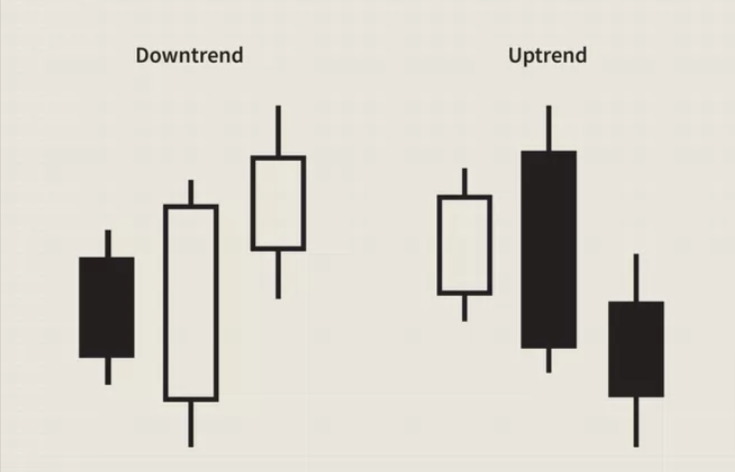

Three Outside Up: A bullish reversal pattern that is formed by three consecutive bullish candles. The first candle is a bearish candle, the second candle is a bullish candle that opens within the range of the first candle, but closes above its high, and the third candle is also a bullish candle that opens within the range of the second candle but closes above its high as well.

-

Three Outside Down: A bearish reversal pattern that is formed by three consecutive bearish candles. The first candle is a bullish candle, the second candle is a bearish candle that opens within the range of the first candle, but closes below its low, and the third candle is also a bearish candle that opens within the range of the second candle but closes below its low as well.

-

Three Black Crows: A bearish reversal pattern that is formed by three consecutive bearish candles, each with a lower close than the previous candle. It indicates that the bears have taken control of the market and that the bulls are losing their grip.

-

Three White Soldiers: A bullish reversal pattern that is formed by three consecutive bullish candles, each with a higher close than the previous candle. It indicates that the bulls have taken control of the market and that the bears are losing their grip.

It's important to note that these patterns are not a guaranteed reversal and that there may be false signals. Traders should use proper risk management techniques and consider other technical and fundamental analysis before making any trading decisions.

Table of Contents

What is Three Outside Down candlestick pattern

A Three Outside Down candlestick pattern is a bearish reversal pattern that is formed by three consecutive bearish candles. The first candle is a bullish candle, the second candle is a bearish candle that opens within the range of the first candle, but closes below its low, and the third candle is also a bearish candle that opens within the range of the second candle but closes below its low as well.

This pattern indicates that the bears have taken control of the market, and that the bulls are losing their grip. This pattern is considered to be more significant when it occurs after an uptrend, and it is usually seen as a sign of a potential trend reversal to the downside.

What is Three Outside Up candlestick pattern

A Three Outside Up candlestick pattern is a bullish reversal pattern that is formed by three consecutive bullish candles. The first candle is a bearish candle, the second candle is a bullish candle that opens within the range of the first candle, but closes above its high, and the third candle is also a bullish candle that opens within the range of the second candle but closes above its high as well.

This pattern indicates that the bulls have taken control of the market, and that the bears are losing their grip. This pattern is considered to be more significant when it occurs after a downtrend, and it is usually seen as a sign of a potential trend reversal to the upside.

Conclusion

Traders often use this pattern in combination with other indicators and analysis such as trendlines and trend analysis, to confirm the bullish reversal signal. It's important to note that this pattern is not a guaranteed reversal and that there may be false signals. Traders should use proper risk management techniques and consider other technical and fundamental analysis before making any trading decisions.