A Butterfly Options Strategy is an options trading strategy that involves buying call or put options at a specific strike price, while also selling a larger number of call or put options at a higher strike price and a lower strike price. The goal of this strategy is to profit from a specific price range or to hedge an existing position.

Table of Contents

There are two main types of Butterfly options strategy:

-

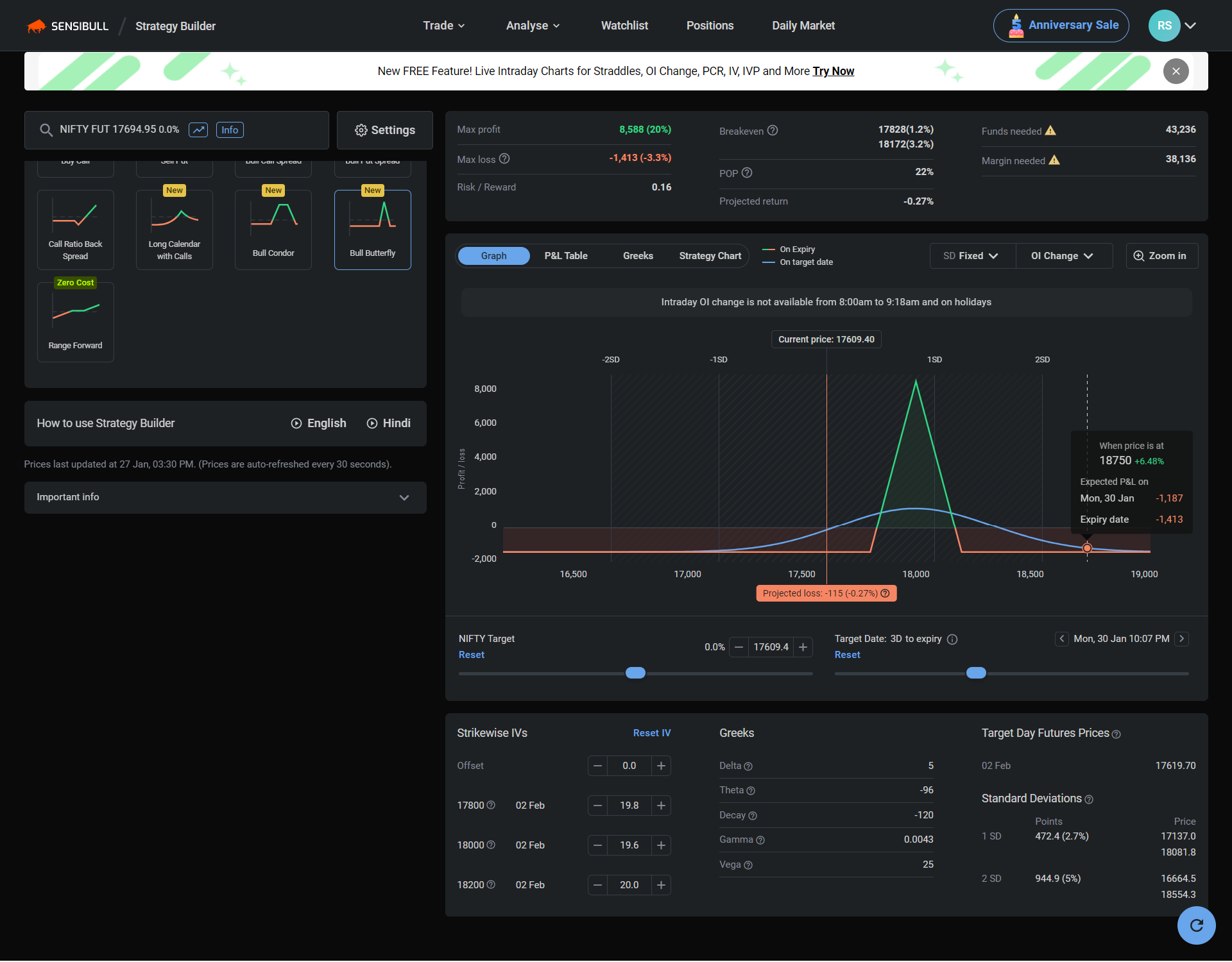

Bullish Butterfly: Involves buying a call option at a specific strike price, selling two call options at higher strike prices, and selling one call option at a lower strike price. This strategy is typically used when the trader expects the price of the underlying asset to increase but with limited upside potential.

-

Bearish Butterfly: Involves buying a put option at a specific strike price, selling two put options at lower strike prices, and selling one put option at a higher strike price. This strategy is typically used when the trader expects the price of the underlying asset to decrease but with limited downside potential.

The Butterfly options strategy can be used to create a profit in a specific price range and also to hedge an existing position, by limiting the potential loss. However, it is considered to be an advanced strategy and requires a good understanding of options trading and volatility. Additionally, as with any options strategy, it is important to consider the risks and use proper risk management techniques.

A Bullish Butterfly options strategy is an advanced options trading strategy that can be used to profit from a specific price range or to hedge an existing long position. Here's an example of :

how to apply a Bullish Butterfly strategy

-

Identify the underlying asset: Select the underlying asset you wish to trade, such as a stock, index, or commodity.

-

Set the strike prices: Choose three strike prices for the options you will buy and sell. The middle strike price should be at the current market price or slightly above it. The higher and lower strike prices should be set at a specific price range where you expect the underlying asset to be by the expiration date.

-

Buy the options: Purchase one call option at the middle strike price.

-

Sell options: Sell two call options at the higher strike price and one call option at the lower strike price.

-

Monitor the trade: Keep an eye on the underlying asset's price, and the option's prices and volatility. Adjust the trade if necessary by buying or selling additional options as required.

-

Expiration: Close the trade or let it expire on the expiration date. If the underlying asset's price is within the specific price range you set, you can make a profit.

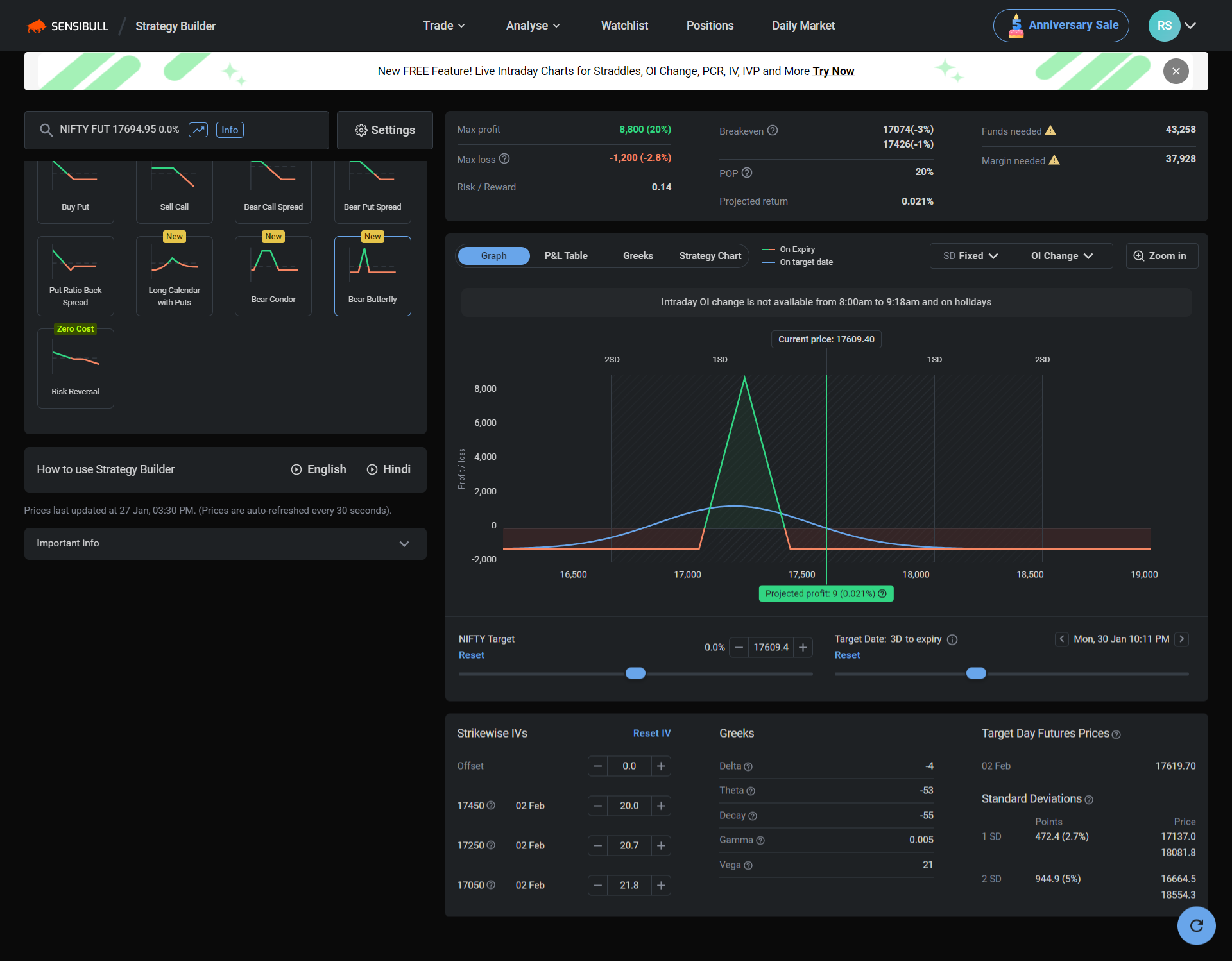

A bearish butterfly options strategy, also known as a short butterfly spread, is a strategy that is used to profit from a decrease in the price of an underlying asset. The strategy involves selling two at-the-money options and buying one in-the-money option and one out-of-the-money option.

how to apply a bearish Butterfly strategy

-

Identify a bearish market or asset that you believe will decrease in price.

-

Select the strike prices for the options you will use in the spread. The strike price of the at-the-money options should be close to the current price of the underlying asset, while the strike price of the in-the-money option should be lower than the current price and the strike price of the out-of-the-money option should be higher.

-

Sell two at-the-money options and buy one in-the-money option and one out-of-the-money option. This will establish the spread.

-

Monitor the underlying asset and the options prices. As the price of the underlying asset decreases, the options will increase in value.

-

Close the position by buying back the options you sold and selling the options you bought when you believe the underlying asset has reached its lowest point, or when the options have reached their maximum value.

It's important to note that this is just an example and that options trading can be quite complex and require significant knowledge and experience. Additionally, It's important to consider the risks involved in any trading strategy and to use proper risk management techniques. It's also worth to mention that the Bullish Butterfly strategy is generally used when the market is expected to remain range-bound or at least not to make a large move in either direction.